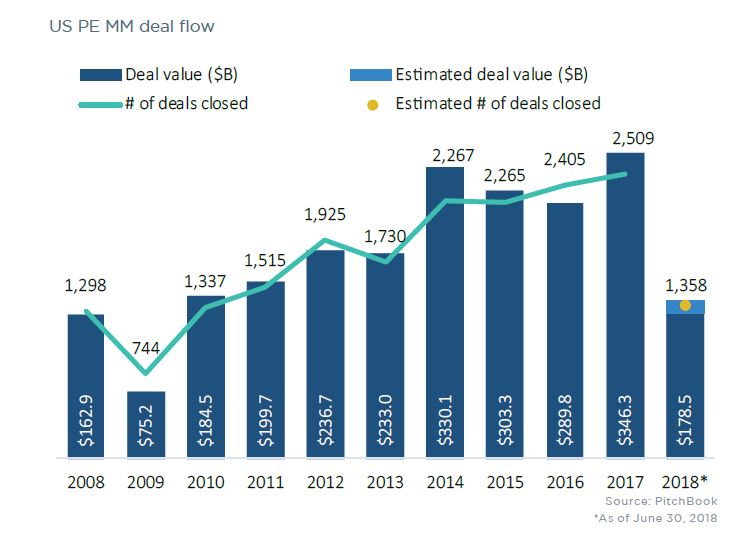

2018 is on pace to match 2017’s record activity levels.

The first half of 2018 has continued the record activity seen in 2017 with regards to middle market private equity investing according to the recent “U.S. PE Middle Market Report” released by PitchBook. During the first half of 2018, middle market private equity firms invested in 1,358 deals worth over $178B, increases of 16% and 5%, respectively, over the first half of 2017. Private equity investment in middle market companies is expected to eclipse $300B in 2018, which would make it four out of the past five years that total investment has eclipsed that mark. The middle market continues to dominate the overall share of private equity capital, as nearly 70% of all private equity capital invested in 2018 has been directed to middle market opportunities. A significant driver of the increased deal activity has been private equity portfolio companies’ focus on inorganic growth through add-on acquisitions. Add-on acquisitions have accounted for 53% of middle market deals, and the average size of add-on transactions has continued to grow.

Fundraising activity has also continued to be strong, with over $61B raised during the first half of the year. Total fundraising activity is expected to be near the totals achieved in recent years, which has been relatively consistent, averaging $129B per year during 2015-2017. First-time funds have also had success in 2018, suggesting there is still sufficient appetite among LPs for middle market private equity investment opportunities. While the current positive U.S. economic environment and favorable lending practices suggest continued positive momentum, potential headwinds related to international trade and the effects of tax reform on certain aspects of private equity investment could become more prominent in the second half of the year or early 2019.

What does this mean for family businesses? The capital markets continue to be receptive to transactions involving strong middle market companies. Capital is still readily available from both private equity firms and the lenders that provide significant financing for transaction activity. Transaction timing may become more of a concern going forward, as markets have been relatively strong now for several years, and some potential signs of speed bumps are worth monitoring more closely. However, for family businesses that have positioned themselves for a potential liquidity event, the current market environment presents an attractive opportunity to raise capital on family-friendly terms.