Significant capital availability, coupled with favorable debt financing, still present in today’s market.

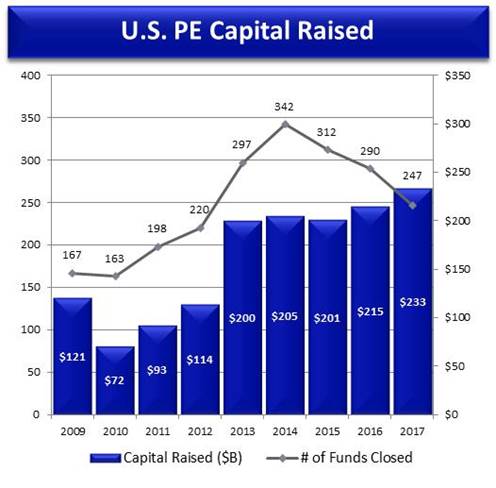

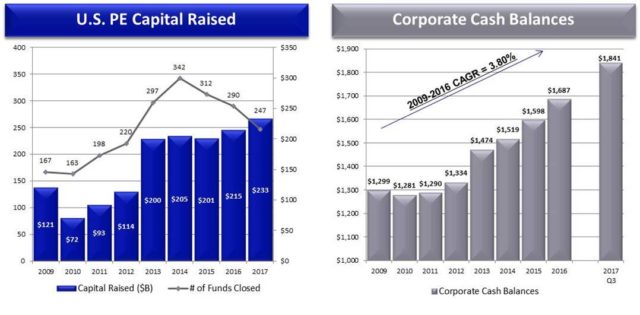

As the New Year begins, business owners’ attentions turn to the outlook for the coming year. Over the past few years, the capital markets have been robust, and private equity firms, as well as both private and public corporations, have raised a significant amount of capital and stockpiled deployable funds. According to Pitchbook, in every year since 2013, U.S.-based private equity funds have raised over $200B per year of new private equity funds, culminating in $233B of private equity capital raised in 2017, an 8.4% increase over the prior year. Over the same 2013-2017 period, corporate cash balances of non-financial businesses have increased from $1.474 trillion to $1.841 trillion, according to the Federal Reserve. While some of these reserves are likely set aside for organic growth initiatives, corporations are faced with continual pressures to show meaningful growth and shareholder value creation, and often turn to acquisition initiatives to achieve their growth goals.

In conjunction with abundant equity capital availability, the debt markets continue to be aggressive in providing favorable, and more flexible, financing options. According to GF Data, debt to EBITDA multiples for private equity transactions have stayed consistent in the 4.0x range for the past few years. While the cost of debt has crept slightly upward over the last 8 quarters due to increases in LIBOR, the spread over LIBOR has not changed materially, keeping overall senior debt pricing in the 5% range, which is still fairly inexpensive by historical standards.

What does this mean for family businesses? The combination of abundant equity capital and favorable financing has continued to buoy rising valuations, making it an advantageous time to raise capital or be a seller. Whether 2018’s primary goal is business growth, shareholder liquidity, or a combination of both, the capital market environment to implement those initiatives has rarely been more receptive.